Transcript of the questions asked and the answers given by Jean-Claude Trichet, President of the ECB, and Lucas Papademos, Vice-President of the ECB Question: Did you discuss the pace and timing of future rate hikes and, in that regard, I noticed that you say that you will be monitoring very closely the conditions moving forward. Previously, when you have used that phraseology, you have proceeded with an interest rate increase two meetings later. So, if in case your baseline scenario is confirmed, would it be a reasonable assumption to be looking toward October? Trichet: I stick to what I said in my introductory statement. As you heard, it is our sentiment that if our baseline scenario is confirmed, we will progressively withdraw the present monetary accommodation. That is clearly the way we are looking at the situation and also the way that observers are looking at the situation. I do not want to say anything else, but we will continue to monitor the situation very closely. I will not comment on your own hypothesis.Question: I like to try you again on that question: what was the flavour of the discussion on the Council today, are we more likely to see a step in two months or three months? My second question is: the Bank of England today raised interest rates somewhat unexpectedly. Do you think that markets and observers are in any way underestimating the threat inflation poses at the moment? And the extent to which central banks will raise rates to counter that? Trichet: I will not comment on the decision of the Bank of England, which happened to be on exactly the same day. As regards our own decision, it was not unexpected. And as regards the way we look at the future, it has been absolutely clear since the very beginning of our first move in December last year that we do not decide ex-ante future decisions over the medium run. I said that we were not pre-committed to any two months, three months or any kind of rhythm. I have always myself said that we depend on the confirmation of our baseline scenario, on facts and figures. We will see what will be the judgement of the Governing Council when the time comes. Again we are not pre-committed in any respect. We will do all what we judge appropriate, depending again on the wealth of information that we have, coming from our own analysis and the very impressive wealth of information and analysis from public and private institutions. As regards the position of central banks in general, as far as you refer not only to us, but to the community of central banks, I would say that we all consider that being credible in our mandate to deliver price stability not only on a short-term basis, but on the medium and long-term basis, and therefore, solidly anchoring inflationary expectations, is of the essence. It is the trust of all central banks I know, and certainly of those with which I am in permanent contact. It is of course, as you know well, our very strong belief. We have a mandate, we are faithful to our mandate and we believe that it is the best way to help growth to be sustainable and job creation which, very fortunately, is now visible, sustainable in the medium and long run.Question: If you compare the situation now to what we have observed at the last meeting, we had some encouraging data but we also had the conflict in the Middle East, would you – looking at the risks to price stability and growth –think the risks have increased or decreased for growth in recent weeks? And the same please for price stability? Trichet: As I said, we depend permanently on new information. I also mentioned the fact that we live in a world where uncertainty, and indeed great uncertainty, is unavoidable. This is particularly the case as regards the geopolitical risks that I mentioned. I would say that on a short to medium-term basis, the risks to growth are in our opinion balanced. On a longer-term horizon, we see a number of downward risks. That is the best summing-up of our present view. On the particular impact of geopolitical risks, I do not see, at this very moment that these have contributed in any significant fashion to hampering growth. But it is clearly a risk that has to be taken into consideration. Fortunately, I have not seen, and I hope strongly not to see, an impact of these events on global growth. Question: Three brief questions. After the last policy meeting, a lot of the ECB watchers shared the view that the Council would prefer to move gradually on interest rates, unless it was unavoidable. And to do so more frequently, if needed, than over a sharp interest rate move. Would you say that is a fair appraisal of the Governing Council’s sentiment? And the second question is: do you believe that concerns about financial stability or financial imbalances in the euro area have increased since the early months of this year? And, finally, you mentioned just now the moderation in M3 growth. I would just like to ask if you feel that is a sign in your view that policy changes are starting to take effect in the euro area? Trichet: On your first question, I already said, that we are not pre-committed in any respect. We do what we judge to be appropriate and necessary, and I think that the market has understood that pretty well. There is no particular rhythm of three or two months. We are not pre-committed as regards the frequency of our progressive withdrawal of monetary accommodation, if facts and figures confirm our baseline scenario. And we will continue to behave in this fashion.I will not comment on financial stability. I do not see any element that would be significant at this stage. On M3, as I said, we have observed a certain signal which, of course, is difficult to interpret at this time. The decisions we took since December as well as the fact that the market is anticipating our decisions, and that the yield curve is showing an upward trend, all this has played a role. Is it a sufficiently significant influence to trigger what we are observing now and marks the beginning of a deceleration? We will see. Of course, I prefer what we have observed n the last statistics to the previous evolution. Note the figures are still very impressive. When you look at the figures we have, particularly as regards loans to the private sector, loans to non-financial corporations – which are increasing at a pace of 11.5% in June, compared with 11.3% in May – we still have very strong dynamics. And the pace continues to increase as regards that particular segment of loans, even if loans to the private sector in general decreased slightly to 11% in June from 11.4% in May. But again it is something that we will continue to look at very carefully. Look at the components of M3. Look at its counterparts. And better understand all the dynamics that are at stake. Again I will not, at this stage, say “we now clearly see the first signs that what we have been doing in increasing our interest rates is working”. But our policy changes are, of course, playing a role because the interest rates applied by the banks that are granting those loans are rising. Question: I have two brief questions. First, I wonder if you can tell us whether the decision today was unanimous? And, secondly, you have just stressed the Bank’s mandate of price stability. But projections, including the Eurosystem’s own, forecast that growth will slow down in 2007. So I wonder whether you can tell us whether there has been a discussion of a situation in which you have simultaneously rising inflation pressures and slowing growth, and what that discussion was like? Trichet: First of all, the decision in favour of a 25 basis point increase today was overwhelmingly supported by the Governing Council. As regards our assessment on the risks to price stability and to growth I have told you clearly that we saw the risks to price stability over the short, medium and long term to be on the upside. We consider the risks for growth to be balanced, on a short to medium-term basis, and to be on the downside over the longer term. That is our present analysis. That being said our mandate is clear. We have to deliver price stability. It is not only the mandate given to us by the Treaty but also our responsibility vis-à-vis the households of Europe and the fellow citizens of Europe, who expect us to deliver price stability. It is also the working assumption of the social partners. And this is the reason why we tell them: be responsible yourself, because we will take care of price stability. It is also essential because it is through our credibility that we anchor inflationary expectations. As I said in my introductory statement in the euro area we have long-term rates that are favourable to sustainable growth and sustainable job creation, in particular, because we are solidly anchoring inflationary expectations. We see no contradiction between our mandate and sustainable growth and sustainable job creation.Question: Could you give us the flavour of your thinking regarding the pass-through of past oil price rises and commodity price rises in general through the price chain, whatever you want to call it. There has been some evidence in the surveys that this is creeping closer to the consumer, but perhaps this is not quite there yet. My second question is on the fiscal side of things. I wonder if you could just elaborate a little bit on your point of needing change on the expenditure side. My understanding of the fiscal structures of the Stability Pact was always that this was one area where governments preserved, and indeed deserved, their leeway as to how they chose to balance their budgets. It surprises me somewhat that you appear to be telling euro area governments that they should not raise taxes, that they should cut spending. And my third question is just a very small factual one. I realise that Slovenia is a very small new member of the euro area. But does this have any sort of one-off effect on the statistics or what one observes on the economic activity in the euro area as a whole, since its composition is changing, however slightly. Trichet: On the first point, I mentioned the risks that we saw to prices and I mentioned a number of those risks – such as the increase in the price of oil – which we have observed in the past, unfortunately, I have to say, and which are still a risk. I mentioned additional increases in prices – I am not mentioning past increases that have already been decided and fully incorporated in our own projections, but rather the possible future increases in administrative prices and indirect taxes – and I mentioned the traditional – in this press conference – second-round effects, in particular wages and salaries increases. There is also the point which you have mentioned, which we consider ourselves to be very important and which has to be examined very carefully, namely what we call a stronger than currently anticipated pass-through of past oil prices and I could add of past commodity prices. There are increases in input prices that do not materialise immediately in increases in output prices, in manufacturing goods or in the services prices concerned, but this process is going on, on a continuing basis and that is something which has to be followed very carefully. That would be my comment on your first question. Just because you don’t see an immediate effect, an immediate mechanistic effect of these increases in oil and commodities prices, that does not mean that you do not have in the pipeline costs that would push prices up later on. This is difference from the second-round effects.On the fiscal side, I would only say that we have always told our interlocutors, the Commission and the executive branches, that in delivering the appropriate fiscal position required by the Stability and Growth Pact, in an overwhelming majority of cases, to be as sound and reasonable as possible on the expenditure side is the first best option. Then, if something remains to be done, in order to meet this Stability and Growth Pact requirement, you have to do what remains necessary on the receipt side namely taxation. But the first best option is always to have a sound handling of the expenditure side. There is nothing new there; we have always said that. And I have to say, that it is particularly true in the euro area, where the level of public expenditure – public spending as a proportion of GDP – is quite significantly higher than the OECD average or the G7 average. So we have to be fully conscious of that structural difference. As regards Slovenia, of course we are very happy to be enlarging the euro area and we will have a fully fledged set of statistics that will permit a full comparison of what happens from 1 January next year with what has happened before. So, you’ll have all possibilities to compare statistics of the highest quality on a state of the art professional basis. But allow me to stress that we had an important message in relation with Slovenia. Perhaps you have noticed that we’ve said that we will be, when next year starts, in a euro area with 13 economies instead of 12 sharing a common destiny with a single currency. We consider that it would be very opportune for labour mobility between Slovenia and the European Union and in particular with all the members of the euro area, to be totally free without barriers within a single market area with a single currency, full labour mobility is absolutely necessary. Question: Mr Trichet, I have two questions. You said that there was an overwhelming majority in favour of the decision you made today in the Governing Council. I take from that word that there were perhaps two or three members who might have preferred, at least at the start of the discussion, another decision. What did they want? Did these members not want to move at all with a rate hike today or did they prefer to have a larger hike? Trichet: Let me be more precise. By “overwhelming majority” I meant a fully-fledged consensus. There were no other views on today’s decision. Question: The second question I have relates to the economic outlook in the short and medium term and then the medium to longer term. There are a lot of economists seeing that there might be some kind of cooling down in the euro area economy. Do you have a discussion in the Governing Council – assuming that you want to normalise interest rates, whatever you regard as a normal level – do you have a discussion in the Council that the time is running out for interest rate hikes? Trichet: First of all, the “normal level” for us is the level which permits us to deliver price stability over time, be credible in the delivery of price stability over time and solidly anchor inflationary expectations. There is our compass and the needle of the compass. Second, as I have said very often, we are pragmatic. Everybody knows what our definition of price stability is. Everybody knows what our determination is. Everybody knows what our two-pillar monetary policy strategy is. Now, we will do what is necessary, depending on facts and figures and new events. At this stage, I will not comment further. Of course, we will have new projections, as you might expect. We have our present projections. We have our baseline scenario and we might have a lot of new events – price of oil, geopolitical uncertainty, also good surprises that we might have in the rest of the world. We could also be – I do not exclude that at all – surprised by the dynamism of the domestic economy of the euro area. We have a number – as you know very well, better than anybody – of survey indicators that are very impressive and that are still not materialising fully – particularly in the service sector, where the survey indicators are much better than the present so-called hard figures. I do not believe that hard figures are the only reliable figures or that survey figures are the only reliable figures. We have to make the best out of this wealth of information, but it is clear that there are areas where we could have good surprises. Again, even if I said that our own sentiment for growth was balanced on a short-term basis, it means that we have downside risks on the one hand, but we have also upside chances on the other hand. And we have to take that into consideration also. That being said, you can count on us to do what we judge necessary. If our baseline scenario is confirmed, if our assumptions are confirmed, then we will progressively withdraw monetary accommodation. Question: Mr President, you mentioned that the euro area will grow around a potential rate? Can you define “potential rate”? The potential rate was, in former days, at the beginning of the euro area eight years ago, approximately 2 ½ %. Some economists said that it is lower now. What is necessary to increase this rate? And what is the defined “potential rate” you have mentioned without giving a figure? Because the potential rate was, in former days, a very important number for anchoring price stability; I remember the “M3 reference value”. Trichet: You know that there are a number of analyses which do not converge in the direction of an overall consensus on our growth potential. And you have also to distinguish the short-term growth potential, and the medium and long-term growth potential. Let me first address the very important issue of labour productivity increases. I would like to take advantage of your question, which is extraordinarily important, to mention the fact that our main handicap in terms of growth potential remains the fact that productivity growth is much too small in the euro area. During the last five years, say, we have been at a level which is half the level observed in the United States in terms yearly increase of labour productivity and which is also half the level observed in the economies of the euro area in the eighties. If we were at the level that we had in the eighties, or if we were at the level which is presently posted by the United States, we would have a growth potential which would be significantly higher. This is the reason why we are calling for structural reforms, because we firmly believe that it is the lack of structural reforms particularly in a period of very rapid changes in science, technology, and globalisation, that explains why we have a disappointing level of increase of labour productivity. That being said, you asked for figures. We will not underwrite any figures ourselves. But I can mention a number of studies which suggest that, for the euro area as a whole, we could be at the level of 1.9%. Others suggest that we are in-between 2% and 2.5%, but possibly much closer to 2% than to 2.5%. You have a number of such analyses. And again, I will not underwrite any figures, but I would say that if you said in the present situation that perhaps 2% might be an order of magnitude it would not necessarily be absurd. But, again, one has to accept there are various methodologies, various views – short-term and more medium and long-term. In any case, our growth potential should be much higher. It is not a parameter which is fixed and immobile. It depends on what we do. And it can be much higher. Question: Do you remember your dinner speech on 31 March at the IIF meeting in Zurich? There you mentioned a figure: was it 1.8 or 1.9? Trichet: My memory is that I mentioned a figure of around 1.9.Question: You referred to the survey data that has been relatively good. However, some of it has started to soften a little bit, to come off the peaks. Has the business cycle in the euro zone peaked? And secondly, on budget consolidation, we have numbers from Germany and some numbers from Italy, and economists are starting to estimate what impact this will have on growth in 2007. The estimates range between 0.5 and 1.3 – those that I have seen – in terms of reducing GDP growth next year. What is your estimate of what impact fiscal consolidation could have next year? Trichet: Taking the second question first. You know that we consider that fiscal consolidation – at the present level of the risks and dangers that exist in the various economies of the euro area today – is improving the confidence of entrepreneurs, the confidence of economic agents in general and the confidence of households. All the mechanistic computations that would go through mechanistic models are not necessarily reliable, because they do not take into account what I would call the Ricardian channel. Never forget that, when you are credible in a medium-term path of fiscal consolidation, you are improving confidence. And confidence is one of the ingredients that is decisive to foster growth: fortunately, we are in an episode of improving confidence in Europe. On your first question, I would say that we are totally pragmatic: we will see what happens. I have no judgement on whether some survey indicators have peaked or not. I have mentioned that, particularly in the domain of services, we still see a large gap between the level of survey indicators, which is very flattering and very encouraging, and the level of the so-called hard figures. My intuition is that the hard figures themselves will go up. But we will see what happens, and again, we have to be cautious. Reality is reality, facts are facts, and we have to be humble in front of facts. Therefore I have no comment on whether some survey indicators have peaked or not. But, as you know, some of them are at historical levels which are very flattering. Question: You said in today’s statement that rates are still accommodative and that the further withdrawal of accommodation will be warranted if your main scenario continues to be confirmed. The markets are debating whether rates will reach 3.25% or 3.5% by the end of the year. It sounds from today’s comments very much like you still see some room to move; it does not sound like there is an imminent end to your tightening cycle. I wonder if you could give us your opinion on whether you see that there is some way to go before rates are no longer accommodative. Trichet: Again, I have said all I have to say on that. I can only confirm to you that, if our scenario and our assumptions are confirmed, there will be a progressive alleviation of the monetary accommodation that exists today. I have said that for quite a period of time, and you can see what we have been doing.Let me also mention something which has been discussed in the Governing Council, namely the Doha round. You did not ask many questions on this issue but it is a very important for us. We have always said that a positive conclusion of this round was of the essence. The fact that we are in a difficult episode is something that we follow very carefully. We consider that it is one of the risks that I have constantly mentioned. I would call on all governments concerned to be fully aware of what is at stake in this round of negotiations to make their best efforts to cope with the current difficulties and to find a solution.

[관련키워드]

[뉴스핌 베스트 기사]

사진

사진

김상겸 2억·유승은 1억 받는다

[서울=뉴스핌] 장환수 스포츠전문기자= 2026 밀라노·코르티나담페초 동계올림픽에서 한국 선수단에 1·2호 메달을 안긴 김상겸(하이원)과 유승은(성복고)이 대한스키·스노보드협회로부터 포상금을 받는다. 김상겸에게 2억원, 유승은에게 1억원이 지급된다.

협회는 10일(한국시간) "두 선수의 올림픽 메달 성과에 따라 사전에 공지된 기준대로 포상금을 지급할 예정"이라고 밝혔다.

[리비뇨 로이터=뉴스핌] 장환수 스포츠전문기자= 김상겸이 8일 스노보드 남자 평행대회전에서 은메달을 차지한 뒤 기뻐하고 있다. 2026.02.09 zangpabo@newspim.com

김상겸은 8일 오후 이탈리아 리비뇨 스노파크에서 열린 스노보드 남자 평행대회전에서 은메달을 획득하며 한국 선수단의 첫 메달을 열었다. 이어 유승은이 10일 오전 여자 빅에어에서 동메달을 보탰다. 이들의 메달은 단순한 입상 이상의 의미를 갖는다. 한국 스키·스노보드 역사상 올림픽 두 번째와 세 번째 메달이자, 단일 올림픽 첫 멀티 메달이다.

협회의 포상금 기준은 새삼스러운 것은 아니다. 협회는 2022 베이징 동계 올림픽을 앞두고 금메달 3억원, 은메달 2억원, 동메달 1억원이라는 파격적인 기준을 마련했다. 당시에는 입상자가 나오지 않았지만, 이번 올림픽에서 동일하게 적용됐다.

협회의 포상은 메달리스트에게만 돌아가는 것은 아니다. 올림픽과 세계선수권, 월드컵 6위까지 포상금이 지급된다. 올림픽 기준으로 4위 5000만원, 5위 3000만원, 6위 1000만원이다. 결과뿐 아니라 과정과 경쟁력을 함께 평가하겠다는 메시지다.

[리비뇨 로이터=뉴스핌] 장환수 스포츠전문기자= 여고생 스노보더 유승은이 10일 빅에어 결선에서 동메달을 차지한 뒤 기쁨의 눈물을 흘리고 있다. 2026.02.10 zangpabo@newspim.com

실제로 협회는 지난해에만 세계선수권과 월드컵 등 국제대회에서 성과를 낸 선수들에게 1억5500만원의 포상금을 지급했다. 2016년 이후 누적 포상금은 12억원에 육박한다.

이 같은 지원의 배경에는 롯데그룹이 있다. 2014년부터 회장사를 맡아온 롯데는 설상 종목 지원을 꾸준히 이어왔다. 신동빈 롯데그룹 회장은 이번 올림픽에서 첫 메달을 따낸 김상겸에게 축하 서신과 함께 소정의 선물도 전달한 것으로 전해진다.

신 회장은 서신에서 "포기하지 않고 획득한 결실이기에 더욱 의미가 크다"며 "오랜 기간 설상 종목의 발전을 꿈꿔온 한 사람으로서 앞으로의 여정을 응원하겠다"는 뜻을 전했다. 대한스키·스노보드협회는 올림픽 일정이 마무리된 뒤 다음 달 중 포상금 수여식을 열 예정이다.

zangpabo@newspim.com

2026-02-10 09:27

사진

사진

금감원장 "빗썸 오지급 코인 반환을"

[서울=뉴스핌] 정광연 기자 = 이찬진 금융감독원장이 빗썸 비트코인 오지급 사태와 관련, 가상자산거래소 전체의 구조적인 문제라며 업권 전체를 대상으로 한 규제 강화의 필요성을 강조했다. 오지급 된 코인을 둘러싼 일부 고객과의 반환 논란에 대해서는 법적으로 명백한 '부당이득'이라며 조속한 반환을 촉구했다.

이 원장은 9일 서울 여의도 금감원 본원에서 열린 '2026년도 주요업무계획 브리핑'에서 이같이 밝혔다.

[서울=뉴스핌] 정일구 기자 = 이찬진 금융감독원장이 5일 오전 서울 여의도 국회에서 열린 정무위원회 제1차 전체회의에서 인사말 및 업무보고를 하고 있다. 2026.02.05 mironj19@newspim.com

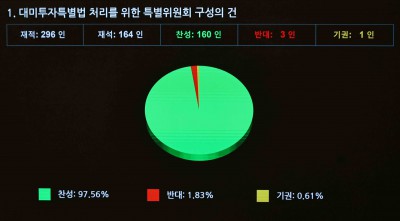

이번 사태는 지난 6일 오후 7시 빗썸이 이벤트 리워드 지급 과정에서 대상 고객 249명에서 2000원이 아닌 2000 비트코인을 지급하면서 발생했다. 총 62만개, 당시 거래금액 9800만원 기준 61조원 규모다.

빗썸은 20분만에 오지급을 인지하고 곧바로 거래 및 출금을 차단했지만 125개(약 129억원)에 달하는 비트코인은 이미 팔린 것으로 파악됐다. 나머지 99.7%에 해당하는 61만8000여개는 회수된 상태다.

이 원장은 이번 사태를 '재앙'이라고 표현하며 강한 우려를 나타냈다. 특히 "빗썸이 보유하지도 않은 '가상'의 코인이 '거래'됐다는 게 가장 큰 문제"라며 "가상자산거래소 전체의 신뢰도를 흔드는 사건이다. 다른 거래소들도 현황을 파악하고 있다. 반드시 개선이 필요한 부분"이라고 강조했다.

다만 오지급에 따른 일부 투자자들의 시세 변동에 따른 피해와는 별개로, 빗썸으로부터 비트코인을 받고도 반환하지 않고 현금화한 고객들에게는 명백한 '부당이득'이라며 법적 책임을 질 수 있다는 점도 언급했다.

이 원장은 "오지급과는 별개로 이벤트는 1인당 2000원이라는 당첨금이 정확하게 고시됐다"며 "따라서 비트코인을 받은 부분은 분명히 부당이익 반환 대상이라며 당연히 법적 분쟁(민사)으로 가면 받아낼 수 있다. 원물 반환이 원칙"이라고 덧붙였다.

빗썸이 보유한 비트코인은 지난해 9월 기준 자체 보유 175개와 고객 위탁 4만2619개 등 총 4만2794개에 불과하다. 14배가 넘는 62만개의 비트코인이 오지급 됐다는 점을 감안하면 58만개에 달하는 '유령' 비트코인이 지급된 셈이다.

이는 비트코인 거래시 실제로 코인이 블록체인상 거래되는 것이 아니라 우선 거래소 내부 장부에서 숫자만 바뀌는 이른바 '장부거래' 구조로 인해 가능하다. 이는 빠른 거래와 수수료 절감 등을 위한 구조로 장부거래 자체가 불법은 아니다.

문제는 빗썸이 존재하지 않는 가상자산이 지급되는 사태를 막기 위한 보안장치를 마련하지 않았다는 점이다. 이 원장 역시 "어떻게 오지급이 가능했는지, 그렇게 지급된 코인은 존재하지 않는 '허상'임에도 어떻게 거래가 될 수 있었는지가 가장 큰 문제이며 정말 심각하게 보고 있다"고 지적했다.

빗썸은 이번 사태를 이벤트 담당 직원의 실수라는 입장이다. 또한 대다수 오지급 비트코인이 회수된 점과 피해가 발생한 고객에 대한 충분한 보상 등을 강조하고 있다. 이미 현금화된 것으로 알려진 30억원에 대해서도 고객 등과 회수를 논의중이라는 설명이다.

하지만 금융당국은 오지급 사태에 따른 강력한 제재를 예고하고 있다. 아직 디지털자산기본법이 입법을 준비중이지만, 현행 가상자산이용자보호법만으로도 과태료는 물론, 영업정지 등의 처분도 가능하다.

오지급으로 인한 파장이 빗썸의 가상자산거래소 운영 자체에도 심각한 영향을 미칠 수 있다. 이번 사태로 고객 자산에 위협을 가할 수 있는 내부통제 등의 문제가 발생할 경우 거래소 인허가권에 제한을 줄 수 있는 조항을 디지털자산기본법에 포함해야 한다는 여론이 커졌기 때문이다.

이 원장은 "일단 장부거래 등의 정보 시스템은 반드시 개선이 필요하다"며 "아울러 디지털기본법이 통과되면 이런 문제가 발생했을 경우 인허가권에 대한 리스크가 발생해야 한다는 문제의식도 가지고 있다"고 강조했다.

이어 "현재 조사가 진행중이기에 이번 사태에 대한 구체적인 언급은 어렵지만 결과에 따라, 위법성이 있는 사안이 확인되면 강하게 대응하겠다"고 덧붙였다.

peterbreak22@newspim.com

2026-02-09 18:14